Fear + Fragility = Fortune.

In our view, sentiment is approaching maximum Fear.

The market appears Fragile.

Let’s do something unconventional.

You have to do something different.

That’s the only way to ‘beat the markets’ and make your Fortune.

MHM opened to members around a year ago and, with the launch of our new model portfolio today, we’re going to do 3 things out of the ordinary for the investment industry:

- Disclose performance on a random day that isn’t a meaningless quarter end date;

- Highlight compelling investment ideas when share price performance currently suggests we’re wrong;

- State all of our ideas (not just the successful ones) and transparently track the performance over time with the launch of our model portfolio.

We believe that with the markets screaming sell, it is time to buy. MHM’s model portfolio is now available to members, incorporating the compelling investment ideas published to date alongside a view on position sizing relative to risk, business model and valuation margin of safety.

MHM’s proposition is not to chase the hot tip of the day. We are not trying to accumulate advertising clicks or generate trading fees. Our target is long-term returns at least in line with inflation after costs (noting just how important costs are to returns), protecting investors’ cash in real terms.

Since we launched around a year ago it’s been what many might consider a tough market – the war in Ukraine, rampant inflation, a Truss premiership, a brief relief rally followed by more inflation fear and finally US regional banks collapsing. The performance of some of our investment idea share prices would suggest that the market is screaming at us that we are wrong.

We believe that in many cases, the companies on our current watchlist have, in fact, increased in value over this period and that the disconnect between price and value has become even greater. Some of the valuations, in our view, can only be described as farcical with market participants seemingly unwilling to do fundamental valuation work in the pursuit of chasing the trend of the day.

We feel that overall sentiment is reaching maximum fear, the market appears fragile and those seeking to make a fortune know that, with patience, it is at times like this when the serious money is made. Rather than quietly keep our ideas to ourselves and avoid the risk of ridicule, we felt that there is no better time to highlight the opportunities while they are available rather than wait to look right and take a victory lap after no-one was able to take advantage.

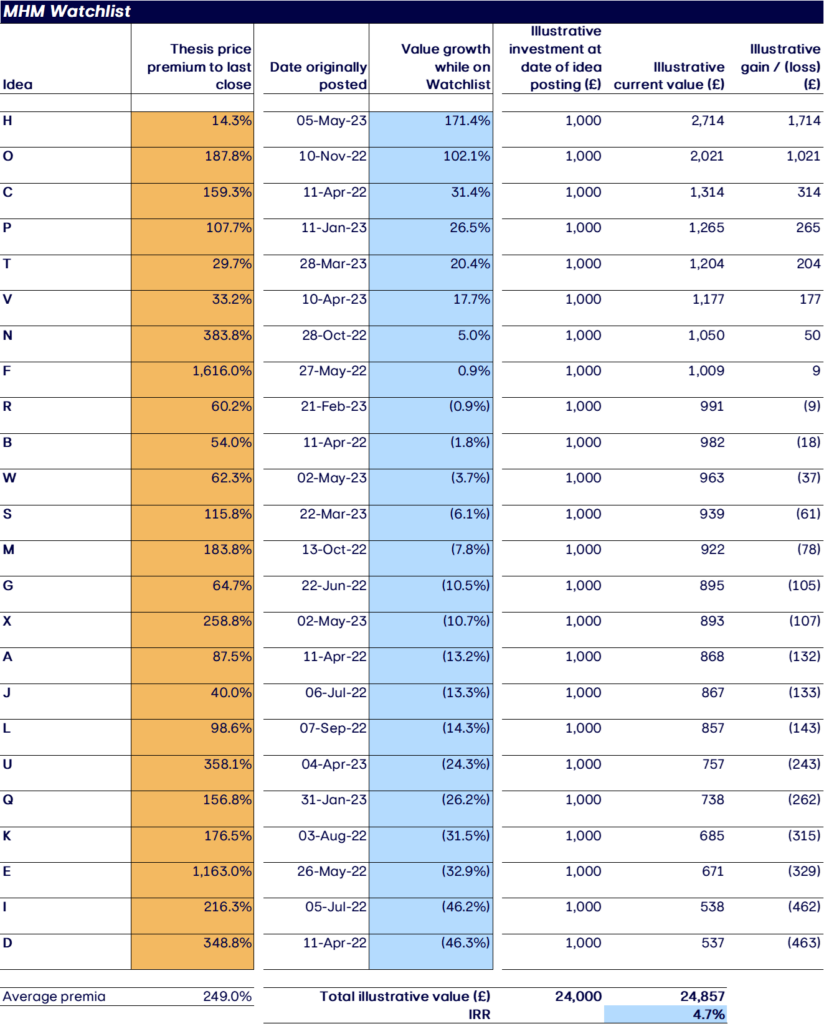

Our ideas have enterprise values ranging from almost zero to c.£15bn, with businesses listed in the UK, the US, Canada and Germany, some of which have global operations or exposure to emerging market growth. They incorporate elements of the AIM All Share index, the FTSE 100 and the S&P 500. Below is a table of the 24 ideas we have posted to date and their share price performance (including dividends) since publication. While the overall result is in positive territory, there’s no hiding that it currently looks like a wide spread of random dispersion. But without context, don’t numbers always lie?

Disclaimer: Past performance is not a guide or guarantee of future performance.

Source of numbers: relevant stock exchanges, Google finance, Moulton Harrox calculations and estimates

If you had invested the same amount, say £1,000, in each of our 24 ideas at the close price on the day each of the ideas were published, you would have generated an IRR of 4.7%1 over c.13 months. Despite being positive and ahead of the indices, it hardly seems like the most exciting proposition, does it? But let’s consider some context relative to the long-term investment returns that we target.

At the end of Dec-22, to take a ‘traditional’ reporting date, the IRR of the then published ideas was 12.1%1. During November 2022 and February 2023, the IRR of the then published ideas was in excess of 20%. Much more respectable and well ahead of our target returns. The difference between those periods and now? Short term market sentiment driven most recently by US regional banking fears and concerns of an impending US recession. We don’t do banks or insurance for the very reasons everyone is now panicking about. In the meantime, our idea companies have continued to perform broadly as we expected.

Additionally, since being published, 3 of our ideas (companies H, N & O) have had share price increases of over 100%, 2 of which have been up over 200%, before coming back down again as overall markets declined. We are believers that volatility isn’t risk and price isn’t value. Long-term performance is the only measure that matters, and we believe the companies on our watchlist still have some way to go.

For comparison, if you were a completely passive investor and simply invested in an index at the point when our original ideas were published your IRR would be:

- AIM All Share: -21.4% (-26.1% compared to MHM)

- FTSE 100: 1.2%, (-3.5% compared to MHM)

- S&P 500: -5.9%, (-10.6% compared to MHM)

Our theoretical ‘average’ performance is, therefore, well ahead of the indices in which our idea companies are included, particularly since many of our off-the-radar ideas are small / micro-cap companies that are either in or would generally be compared to the AIM All Share index.

As always, the most important point is our view of the fundamental value of the businesses, represented by our Thesis Prices. The premia to the current share price that these Thesis Prices represent are the opportunities that we present to members. Each of our ideas also come with a Margin of Safety Price, which incorporates a probability weighted Risk Price to calculate an expected value which is then discounted by a further 15% margin of safety to give our view on the price up to which we would be comfortable buying shares.

Bar one idea, the share price of every one of the ideas has been below the price at publication. With bid-offer spreads and the impossibility of picking price bottoms, you are almost always down on every position you take until sentiment catches up to fundamentals. Our goal is to help members achieve long-term, inflating beating investment success and while the track record of a few months for some of the ideas is nowhere close to proof of anything, we are encouraged by the overall performance in terrible markets, with many ideas yet to reflect any of the upside we see in their current valuations.

People quite rightly focus on the downsides and apparent ‘losers’. Capital preservation is a key component of our thinking. With overall market sentiment currently affecting a number of our ideas, what’s going on with companies D and I, in particular? We are focused on honest appraisals of investments to stem losses from mistakes, but we are far from ready to put either of ideas in the mistake column.

Both have suffered short term delays due to factors outside their control and the markets have indiscriminately punished any sign of failure to meet the next quarter’s expectations. We don’t believe the short-term factors have impacted the long-term value and the market reaction has been well out of proportion to the limited value impact. Indeed, both have recently announced positive progress but in this market, until there is an announcement that allows for clear valuation guidance, value is not being attributed. At current prices, these are two of the most undervalued opportunities we see in the market today and are likely have additional near-term positive catalysts that will allow the market to show interest without having to do any work.

But what of the positives? The results highlight our view that if investments across the portfolio are broadly making inflationary returns, or at worst aren’t losing money, you only need 1 or 2 big winners to really enhance the overall portfolio return. Companies H and O have started to have this effect on the overall performance, while company H remains grossly undervalued in our view. Once Is Chance, Twice Is Coincidence, Third Time Is A Pattern. OK, the actual Ian Fleming quote is obviously “Third time is enemy action”, but please forgive us for utilising the oft recognised mis-quote. You may consider company H to be chance, and company O to be a coincidence, but we are looking forward to one of the other ideas confirming a pattern of identifying outperformers very soon.

Our ideas are categorised to help identify risk profiles and potential position sizing for members (which we are taking further today with the launch of our model portfolio):

Weighing Machine

Companies with a track record of cash generation that provide the foundation of portfolios with an expectation of less volatile, inflation beating returns. Their place in the portfolio is due to market sentiment being dislocated from fundamental valuation.

Early Bird Radar

Earlier stage companies that are revenue generating and close to profitability inflection / cash generation that we believe have the potential to provide outsized returns, but at the expense of greater risk and certainly higher short-term volatility.

Ideas for Research

Effectively pre revenue companies with fantastic business models that are interesting for small allocations as growth could be explosive. These are presented for members to follow and understand in preparation for moving quickly as catalysts are achieved, but with effectively binary outcomes they hold a greater risk of losses. While financial forecasts are of limited use and the range of valuation is so wide, we recently started to provide Thesis Prices for these ideas to provide some sense of the upside available.

We believe that asset management industry costs and fees are appalling and MHM’s solution is a unique way forward for those willing to spend a little time reading and executing a small number of trades. We encourage people to review the returns on their managed investment funds and query whether they are adding the value you expect and whether the cost-benefit analysis is as favourable as MHM’s. The market never stops teaching you lessons and we’re trying to improve every day. The only way to really learn is by putting your own money to work based on your own investment decisions.

The ideas that are published come from years of screening, personal investment and learning lessons the hard way. One of our key learnings has been greater situational and momentum awareness rather than pure undervaluation. Something hugely undervalued can clearly get even more undervalued for some time before sanity prevails. While not attempting to perfectly time market bottoms, to achieve better in prices we have developed (we believe) a keener sense of short-term news flow and giving management teams less benefit of the doubt when it comes to avoiding what look like obvious missteps. Over-confidence and complacency are killers in investing and our heads will remain firmly down and focused on rooting out and evaluating the most compelling ideas as we aim to build a long-term track record that will allow compounding to work its wonder.

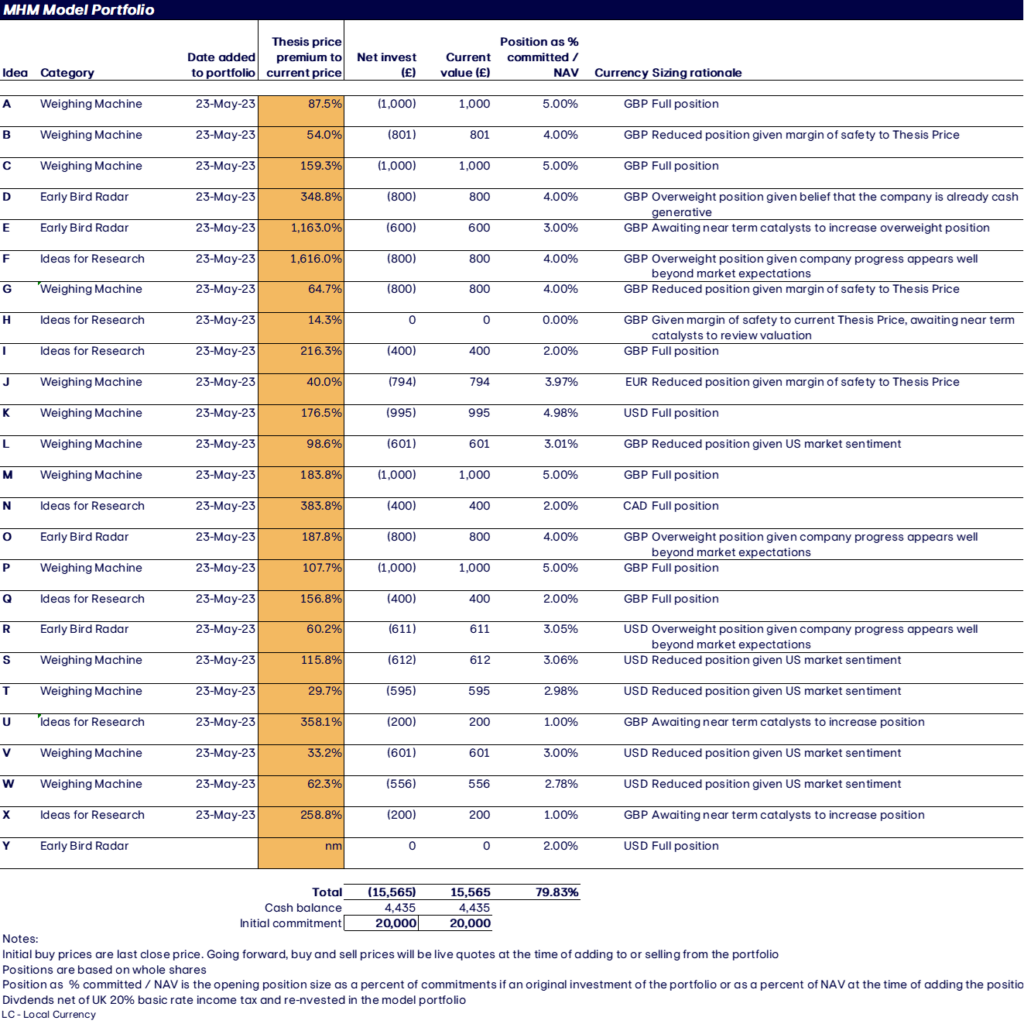

With a critical mass of ideas now published and as a signal of how much opportunity we believe the market is currently offering, we are today launching our model portfolio incorporating our ideas to date, all of which we believe remain undervalued. There is an allocation for our latest idea which will be published shortly for members leaving us with 25 investments in our initial model portfolio. We believe this is too many for a high conviction, concentrated portfolio and is a function of the level of opportunity we see today. We expect this number to fall over time to a model portfolio of 15-20 companies due to:

- funds realised from appreciated shares prices being recycled into companies where the market has not yet recognised the undervaluation or whose performance merits a greater weighting;

- removal of ideas where we are wrong – there’s simply no way to achieve a 100% success rate in investing and we don’t have the hubris to suggest we can;

- likely additions from 3-4 new ideas published each year aiming to take advantage of further opportunities in irrational markets, which will need to be more compelling than portfolio investments to warrant an allocation.

Obviously, everyone has different levels of investment, and the position sizing can be scaled as appropriate, but for the purposes of our model portfolio we have chosen to use an illustrative £20,000 portfolio, which is broadly the annual ISA allowance in the UK. It is our intention going forward to notify members on our mailing list of changes to the model portfolio at the point that we make them, making our offering a little more interactive. Each trade will be recorded, and the portfolio tracked with every winner and every loser. Fully accountable and transparent, as we believe all investment ideas should be. We will, of course, continue to post timely company updates on our discussion boards to keep members abreast of relevant news and company performance alongside rationales for position sizing.

Assuming 20 positions on average going forward, a full position size will be 5% for Weighing Machine companies, which will flex up or down to reflect the level of undervaluation and business model risk. For Early Bird Radar and Ideas for Research, position sizing will generally be limited initially to 2% to reflect the risk, but again this will flex up or down depending on stage of development, company performance and catalysts. We also initially retain a c.20% cash balance to allow us to add to positions awaiting an identified catalyst (where there is a risk of downside if the catalyst does not emerge as expected) or take advantage of market sentiment, for example, companies located in the US where bank collapses, interest rate uncertainty and debt ceiling negotiations could impact prices across the board in the near term. Here is our initial model portfolio:

If you are interested in taking advantage of the investment opportunities presented above, please join us to access the full model portfolio, our idea memos, ideas for research and discussion boards with additional company updates and commentary.

We thank all our current members for their continued engagement and look forward to welcoming new members with long-term investment horizons who share our view that Fear + Fragility = Fortune.

As a final note, it is perhaps worth highlighting that Moulton Harrox Ltd is an appointed representative of Messels Ltd which is authorised and regulated by the Financial Conduct Authority.

- These returns likely don’t reflect any of our member’s results exactly. People have obviously joined at different times, could have bought or sold at higher or lower prices, have encountered bid-offer spreads, and taken different weightings in ideas that they held more or less conviction in.