Empowering individual investors

Moulton Harrox Members (“MHM”) is for people interested in investing and ready to make their own investment decisions but who don’t have the time to uncover compelling, off-the-radar ideas.

We collaboratively and proactively engage with companies to provide collective investor insight and drive positive change.

Compelling, actionable equity investment ideas

Shareholder Engagement for Positive Change

- Access to model portfolio of 20-25 actionable, off-the-radar investment ideas

- 3-6 new memos for compelling investment ideas each year

- Ongoing portfolio company monitoring and updates

- Access to member discussion boards

- Access to case studies, investor resources and guides

- MHM engagement with listed company management to deepen knowledge base

- Collective member insight and feedback to management teams through the ‘single voice’ of MHM

- Unlocking shareholder value for individual investors

Finding investment ideas takes a huge amount of research time and due diligence – time many of us don’t have.

Therefore, investment decisions are often handed to third party managers, significantly impacting returns due to fees, or made by utilising share ‘tips’ from sources (sometimes unverified) with their own agendas. Moulton Harrox Members is set to change that.

The platform provides an investment summary, financial analysis and valuation framework for a concentrated number of diligenced ideas that individual investors can execute. A transparent catalogue of case studies of the founder’s investments, alongside an ongoing review of the watchlist of ideas, provide an iterative feedback process for constantly improving pattern recognition of good investments. Incorporating discussion boards, it also provides a professional forum of diverse but like-minded people to share and discuss ideas in a verified environment, improving investment outcomes for all members.

Individual investors can struggle to access company management and boards – MHM is a platform for collective access and engagement.

Public company management and boards can be closed to input from individual investors with a focus on large, institutional shareholders. This fails to recognise the diverse background of individuals who have expert insight and can help increase or realise shareholder value. MHM is a platform for its members to provide insight and feedback on their investments.

Should it be necessary, MHM also has the ‘IP’ and knowledge to be proactive, and we are prepared to help members exercise their shareholder rights. For those seeking change at their investee companies, we can collectively engage to secure demonstrable results.

MHM engagement in action

MHM is a partner of The Engagement Appeal

TEA is the platform for inclusive investor relations. At the heart of TEA’s vision is their white paper that exudes with simple and effective solutions, sustainability, innovation, and togetherness. It calls for better alignment between companies and all their shareholders, promoting mutual understanding and a wider inclusion of views essential for companies to future-proof themselves and address the often-neglected social aspect of ESG.

Just wanted to let you know that I invested in one of your ideas which has performed very nicely for me so thank you very much for putting in the work and onto your list of investment ideas

I really love the quality of the product here, there’s so much more detail than others on the market

Well done for creating a powerhouse that supports investors and helps them to shape their own investment choices

Since signing up as a member I'm blown away by level of detail and research MHM provides - this is the type of diligence that we should all be considering before purchasing stocks. It left me wishing I had this level of insight earlier (and questioning my stock choices pre MHM)

Investment ideas focused on exactly what you want to know as an investor. The thought process and un-hyped conclusions clearly come from an investor who has put his money where his mouth is and has learned from actively being in the market

MHM provides concise memos summarising the thesis but with detailed financial and valuation analysis for those that want to dig in. I’m already making money on a number of the ideas!

MHM is for members only

Moulton Harrox is named after our founder’s primary school as a reminder to never stop learning, and that learning is best achieved through practice and persistence. Our founder has more than 22 years’ experience in financial markets* with a unique profile combining financial, operational and governance expertise. He completed >$30bn of M&A / capital market transactions as an adviser and principal and has held board roles of private equity owned investee companies.

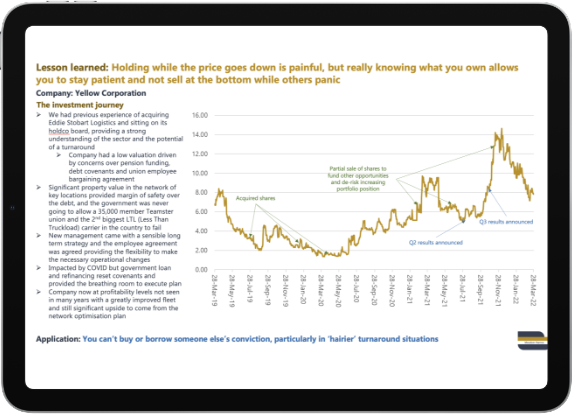

After years of delegating investments to third party managers and having raised and managed private institutional funds, our founder began investing 100% of his liquid assets in a long-term, concentrated equity portfolio in 2019, focused on relatively unknown, off the radar companies with limited research coverage.

This investing journey led to two key insights:

1) Fund management fees do not deliver value in a world where everyone can access the public markets through low-cost broking services; and

2) Well researched and compelling ideas are difficult to uncover by busy individuals who don’t have the time for detailed diligence

Nick Hargrave

Founder & CEO

Sarah Shilling

Strategic Advisor

Our Founder, Nick Hargrave, is now using this experience and an extensive database of screened ideas generated over 10 years of public market investing, alongside learnings and acquired pattern recognition from identifying winners and potential pitfalls, to help democratise investing through Moulton Harrox Members. With a strong value proposition, a willingness to share ideas publicly and a review process that measures outcomes against original theses, the platform is designed to provide the highly differentiated offering for individual investors that is missing from the market.

Additionally, MHM benefits from the expertise of our Strategic Advisor, Sarah Shilling, who is a c-suite level, PR and marketing authority with extensive experience across a wide range of industries. As an Advisory Board member of Angel Academe, the award-winning angel network investing in female-founded tech start-ups, Sarah brings significant investment insight alongside her operational and communications expertise.

Investment idea memos

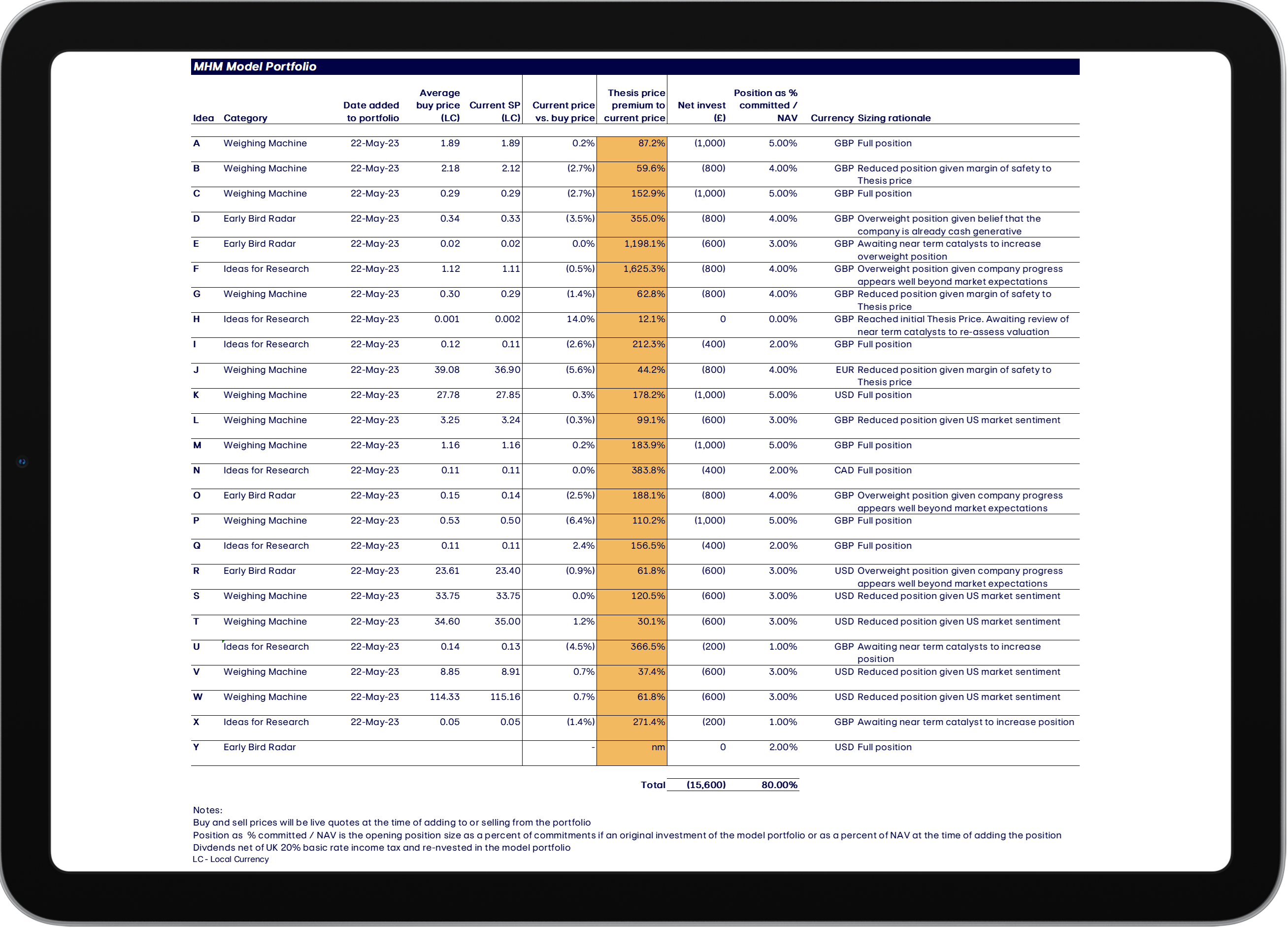

Model Portfolio

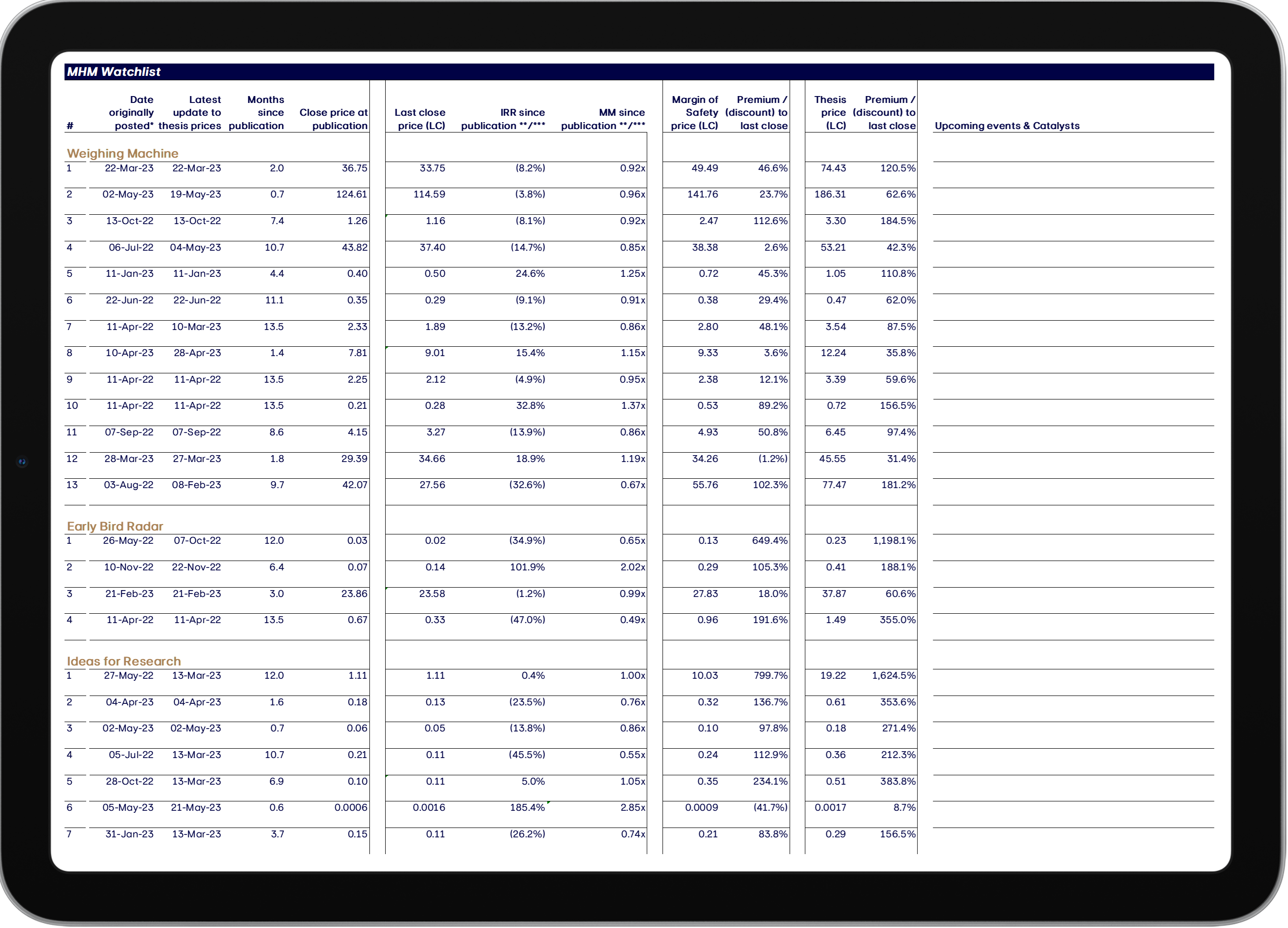

Watchlist

Discussion boards

Case studies

Memo user guide